Like SBRs, many weapons parts are federally regulated. Keep them safe with NFA trusts. A prevalent misconception exists among the general public is that silencers are illegal. Lump machine guns and short-barreled rifles into that questionable group, too. All the previously mentioned weapons can be legally owned by paying a $200 tax and filling out ATF Form 5320.4., a.k.a a Form 4.

The most common manner in which to obtain restricted Class III weapons is to fill out the Bureau of Alcohol, Tobacco, Firearms, and Explosives (BATFE) Form 4. This is the process to register the weapon as “individual” ownership. The second classification, “corporations,” allows incorporated entities to own Class III weapons. A third registration method is to assign your ownership to an NFA trust.

NFA Trusts Are a Popular Method to Own NFA Guns

Creating a trust to own Class III weapons has risen in popularity. As a part of the background check process, the chief law enforcement officer in the community where you live is required to sign off on the Form 4. NFA trusts are a popular option for those communities where that LEO refuses to sign off on the form. The second reason is that registering ownership to a trust gets approval in two to eight months.

Advertisement — Continue Reading Below

The popularity of creating a trust to take ownership of Class III weapons deserves a hard look. Going beyond using a trust to own National Firearms Act (NFA) regulated Title 2 weapons, this method of ownership may be used in states where Title 1 weapons come under close personal scrutiny, too. (Title 1 firearms are the kind that you can go to the local gun shop to buy.) An attorney in your state should make that judgment, though.

Handy around barricades, short-barreled rifles are excellent competitors in 3-Gun competitions. Photo courtesy Matt Howard

Going Corporate

Before diving into the issue of NFA trusts, let’s examine registering weapons under a corporation to help clear the air. Some of the pitfalls of using a corporation instead of a trust include registration of the corporation on an annual basis that require fees from state and local municipalities. There’s also the issue of filing taxes, what to do in the event of dissolution, and maintaining a board of directors.

Advertisement — Continue Reading Below

Legal Advice on an NFA Trust

A trust is an estate-planning document. A trust lives on beyond the life of the person establishing the trust. To get an idea of the benefits of creating an NFA trust, I spoke with attorney David Goldman. He created a network of lawyers who specialize in creating NFA trusts. “The biggest reason that people use trusts is that the chief LEO won’t sign off,” Goldman said. “One of our most frequent users for trusts is police officers. When budgets are tight and the officers want to arm themselves with short-barreled rifles, but their chief won’t sign off. Privacy is another matter.”

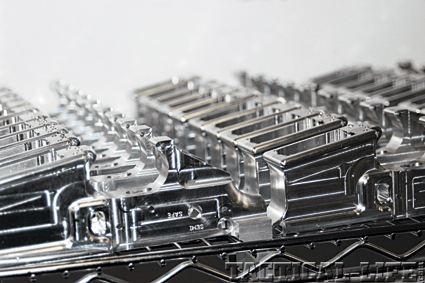

Sun Devil lower. Jeremy Clough photo

Complications

I don’t advocate allowing felons to own firearms. Certain legal judgments don’t take into account every case, though. And, with 50 percent of marriages ending in divorce, it complicates some gun ownership situations. “You don’t have to be a criminal to be a prohibited person,” Goldman said. “I had a client injure a child in a helicopter accident and was convicted of child endangerment. This made him a ‘prohibited’ person. If his 12 machine guns hadn’t been in a trust, they would have been lost.”

Advertisement — Continue Reading Below

“A person cannot purchase a machine gun without a background check just by using a trust. The gun or firearms trust merely prevents the local CLEO (Chief Law Enforcement Officer) from arbitrarily denying qualified individuals the right to purchase a firearm.”

Trusts = Protection

“Besides allowing individuals to protect their right to purchase firearms, these trusts provide protections for the loved ones of gun owners that are not available with individual ownership. Through the traditional purchase route, many individuals are at risk of criminal activity and prosecution for permitting another individual access to the items. In addition, individual ownership does not deal with important issues, such as incapacity or death of the firearm owner.”

Advertisement — Continue Reading Below

‘Likewise, a gun trust addresses the transfer of these firearms to heirs that may not be eligible to receive them. As a gun trust lawyer, I have seen many individuals who were forming corporations, trusts, and LLCs that were generic in nature and did not address their needs. Due to these errors, they placed their families, friends, and children at unnecessary risk. Avoid this risk with an adequate NFA gun trust.”

More Aspects

I then related my interest in setting up an NFA trust with fellow writer, shooter and attorney, Jason Wong. Wong said, “You have to be careful when setting up an NFA trust. I’ve talked to several people who want to take ‘will maker’ software and create a gun trust. There are too many variables in state law to just create a trust in this manner. You run the risk of creating an invalid trust.”

Advertisement — Continue Reading Below

Creating a Legitimate Trust

Wong summarized his caution best in a recent quote. “In some jurisdictions, local chief law enforcement officers will refuse to sign the Form 4 certification, and it can be nearly impossible to complete the form,” Wong said. “In these instances, some buyers resort to using corporations, LLCs, or a trust to avoid law enforcement approval. The BATFE waives the requirements for a photo and law enforcement certification when a non-person entity (such as a corporation or trust) purchases NFA firearms.

Consult an Attorney

“If the buyer is self-employed, he may have already formed a corporation or LLC. In other cases, buyers often form corporations and trusts solely for the purchase of NFA firearms. If a buyer lives within a jurisdiction where a law enforcement certification is difficult or impossible to obtain, he may wish to explore one of these options. Buyers should speak with a lawyer about potential advantages and risks when considering the use of a corporation or a trust. The potential risks include the loss of all firearms if the formation and administrative procedures required of the entity are not followed properly.”

The real difference between a standard lower and one for legal SBRs is the BATFE registration. Jeremy Clough photo

Advertisement — Continue Reading Below

“Depending on the state, it can be as easy as signing a piece of paper. Next, have it witnessed and notarized,” Goldman said in regards to completing a NFA trust. “We participate in the fees for providing the information and federal guidance and the local attorney handles the state issues. It can take 24 hours to turn them around to another attorney, but it usually takes a week.”

Cost of Security

Checking on the cost of establishment, I find it common for estate trusts to run in the $1,500 range. “In most states, we try to find attorneys who will prepare the trusts for $600,” Goldman said.

All in all, if you are in the market to purchase an NFA weapon, consider all the options carefully. If you choose to form a trust, ensure that you weigh carefully the do-it-yourself route. I’ll be using a local attorney to set up mine.

Advertisement — Continue Reading Below